Having everything in-house seems more logical. If we talk about payment processing, bank-owned payment processing systems appear to be a viable choice, primarily because it would cost them less to build their own system than outsourcing to a third-party service provider. Additionally, banks can have more control over the process. Having an in-house team means someone who knows the business internally and can implement any changes instantly. However, several hidden costs go beyond dollars they neglect to consider.

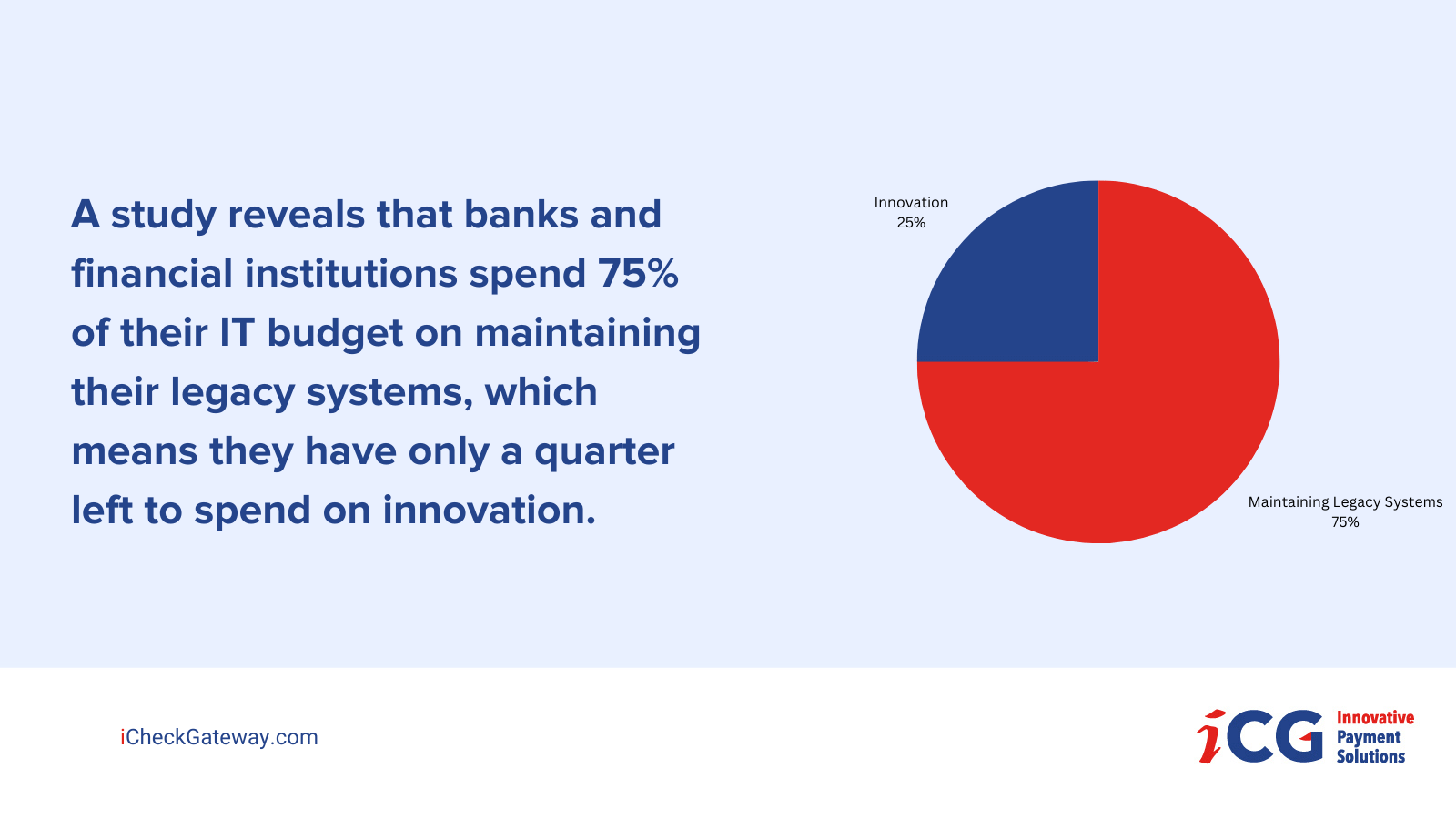

A study reveals that banks and financial institutions spend 75% of their IT budget on maintaining their legacy systems, which means they have only a quarter left to spend on innovation.

In this blog post, we’ll delve deeper into the hidden costs incurred by banks because of maintaining their own payment processing systems, third-party payment processing benefits and misconceptions, and how you can smoothly switch from a bank-owned processing system to a third-party solution.

What Are the Hidden Costs Associated with Bank-Owned Payment Processing?

Let’s begin with how much bank-owned payment processing costs financial institutions:

Infrastructure Costs

Developing a payment processing system requires significant infrastructure investment and substantial upfront costs for hardware, software, and networking equipment.

Maintenance Costs

Building and developing your infrastructure is not the end. When you buy a car, you have to pay for ongoing maintenance and upgrades. Similarly, banks must keep their systems up-to-date with changing regulations and technologies.

Regulatory Compliance Costs

Payment processing is heavily regulated, and banks must comply with a complex set of laws and regulations which change frequently. Banks must maintain compliance documentation, conduct regular audits, stay updated with changes, and implement security measures, which costs time and money. Surveys reveal that the cost of regulatory compliance has increased by 60% in recent years.

Opportunity Costs

While bank-owned payment processing gives more control to banks, it comes with its own limitations. Handling in-house means allocating resources, including personnel, technology, and capital, which bars them from pursuing other initiatives or expanding into new markets.

However, suppose banks form strategic partnerships with third-party solutions. In that case, they only spend capital and become free to leverage their other resources to pursue strategic initiatives to gain potential revenue and growth.

Staffing Costs

Banks must recruit an in-house team of employees to manage and maintain their payment processing systems which require spending time on interviews, hiring, onboarding, training, and creating a workspace for the employees. Moreover, the staff turnover and hiring of temporary staff during peak times add to their expenses.

Payment Disputes and Chargebacks

Payment disputes and chargebacks incur costs that go beyond money. Banks can suffer lost revenue, customer dissatisfaction, customer churn, and damage to reputation.

Chargebacks911 has predicted that banks can lose over $38 billion in chargebacks in 2023.

In addition to this, bank-owned processing systems often need more flexibility, which hampers their ability to scale in the future and adapt to changing markets, customer needs, and regulations.

Third-party processing solutions providers, on the other hand, help banks overcome these hidden costs and limitations with the latest technology, diverse experience, and high-quality transparent services.

Some Common Misconceptions

Even after knowing the expertise and experience, some common misconceptions about third-party solution providers hinder financial institutions from relying on them. Here are a few:

- Third-party providers are less secure than bank-owned payment processing systems. On the contrary, they have experts on board who ensure the company leverages advanced fraud detection and prevention tools.

- Third-party providers are less reliable than bank-owned payment processing systems. Since they work with multiple clients, they know common pitfalls and unexpected errors. Therefore, they have several redundancies and backups in place to ensure uptime and continuity of service.

- Third-party providers are more expensive than bank-owned payment processing systems. While they do charge a fee, they do not have hidden costs and can be more cost-effective in the long run.

- Third-party payment solutions providers offer one-size-fits-all solutions. While it’s true to an extent, several providers like iCheckGateway.com cater to the specific needs of each bank and business to build solutions that work for them. From mobile payments, email invoicing, and credit card and ACH processing to building custom virtual terminals, plugins, and developer tools, they design a system tailored to your goals and needs.

Benefits of Third-Party Payment Processing Providers

- Third-party providers specialize in payment processing, allowing them to leverage economies of scale to reduce infrastructure implementation and maintenance costs.

- They offer various payment options that embed within the existing models lowering the costs of building infrastructures from scratch.

- While the goal is to offer impeccable service to their clients, they also ensure that the systems are ready for peak times and scalability; hence, the solutions are designed to seamlessly accommodate present and future needs.

This is why merchants and leading financial institutions partner with third-party payment processors to optimize their process through a custom payment gateway and expand their products and services.

Choosing the Right Third-Party Provider

When switching from a bank-owned to a third-party payment processing provider, you must consider several factors before deciding. This includes these steps:

- Narrow down the list of reputed providers, preferably NACHA-preferred partners, with a proven track record of delivering high-quality payment processing services.

- Make a cost comparison of payment processing options.

- Ensure the provider has robust security measures in place to protect against fraud and data breaches.

Best Practices for Transitioning from Bank-Owned to Third-Party Payment Processing

Switching from bank-owned to third-party payment processing can be a complex process. Here are a few best practices to ensure a smooth and successful transition:

- Analyze your current payment processing system. What does your infrastructure look like, including hardware, software, and process?

- A thorough assessment will help you identify major issues that must be resolved.

- Choose a third-party payment solution provider with a proven track record in your industry and excellent customer support. Glance through their onboarding process, pricing structure, processing fee, payment methods, and customer support.

- After finalizing and outsourcing payment processing, outline the transition plan in detail with the provider to set clear timelines, and define obstacles to hold involved members accountable.

- Communicate effectively with all stakeholders about the transition, including internal teams, customers, and partners. Inform them about the changes. While your customers may not like it, ensure they understand the process and the benefits.

- Before fully switching to the new model, test it thoroughly to ensure it runs smoothly and meets your needs.

- Offer training and support to your staff and customers so they quickly adapt to the new system. Direct them to support resources and personnel they can connect with for any issues for smooth functioning and customer satisfaction.

- Once you switch to the new model, monitor and evaluate it. Analyze different performance metrics like cost, revenue, customer satisfaction, and efficiency to see if you have achieved your goals.

Bank-Owned Payment Processing Success Stories

N26 + Wise

N26 is a Berlin-based bank who partnered with Wise to create an API platform enabling its customers to send money abroad without any hidden fees. The company expanded its offerings and improve customer experience.

Subaio + ABN AMRO

ABN AMRO, one of the largest banks in the Netherlands, partnered with Subaio to centralize their recurring payments, which led to the formation of Grip App. Subaio created a custom platform for banks to enable a one-stop shop to manage payments online.

Bank of America + Zelle

Bank of America joined forces with Zelle to boost their digital payment offering and simplify mobile payments for their customers. In the first quarter of 2020, users made more than 102 million transactions, amounting to $27 million using Zelle.

It’s safe to say that banks experience an upward rise when partnering with third-party payment processors on various fronts.

Start Your Journey with iCG

Whether it’s a bank or a merchant, revenue growth and customer satisfaction are significant to business growth, and payment processing is crucial. While building in-house seems reliable, it may cost you more in time, money, and effort and lead to missed opportunities, which can significantly impact your bottom line.

Partnering with a third-party solutions provider can resolve the issue, expand your list of services, and upgrade your payment processing with minimal involvement. Ready to make a switch? Partner with iCheckGateway.com.

If you are not sure and need a consultation, book a call with one of the iCG experts and get honest advice to advance your journey.