It’s been said once and will be said a thousand times. The payments industry is constantly changing.

The most recent, and perhaps most significant, evolution is digital technologies and banking. Payment ecosystems have changed since the beginning of the pandemic in 2020 as more customers have moved their preferences to digital and contactless payment models. Statistics show that the number of active online banking users was more than 2 billion in 2022.

The newest process shaping the future of payment processing, Request for Payment (RFP), known as Request to Pay in the U.K. and Europe, adds convenience and saves time with the click of a button. This blog post will explore the newest payment method and how it shapes the future of efficiency and security in payment processing.

What Is Request for Payment (RFP)?

At its core, Request for Payment (RFP) is a messaging system that allows businesses to send bills and invoices directly to customers through their mobile banking app. Customers receive a notification of a new invoice/bill, sign into their mobile banking app, review the details of the RFP, and click to pay right away or schedule the payment.

In addition to using the RFP notification to make a payment, customers can also share any relevant remittance information.

How Does RFP Work?

Like any real-time, instant payment transaction, RFP has a few steps to ensure the customer’s payments are simple and secure. We will take you through the steps of how an RFP goes from a business (requester) to a customer:

-

Requester creates an RFP by providing the required information to its financial institution.

-

A message is formatted and sent either through the FedNow instant payment network or the ACH Network. The network then routes the message to the recipient’s financial institution.

-

The recipient’s financial institution relays this message to the recipient through a notification via text, email, or mobile app.

-

Recipient authorizes an instant payment – RFP settles charges in real-time.

RFP differs from other instant payment options because they are very data-rich. Though all instant payments have data, like account and routing numbers, RFP creates more reliable transaction records by having more detailed data points.

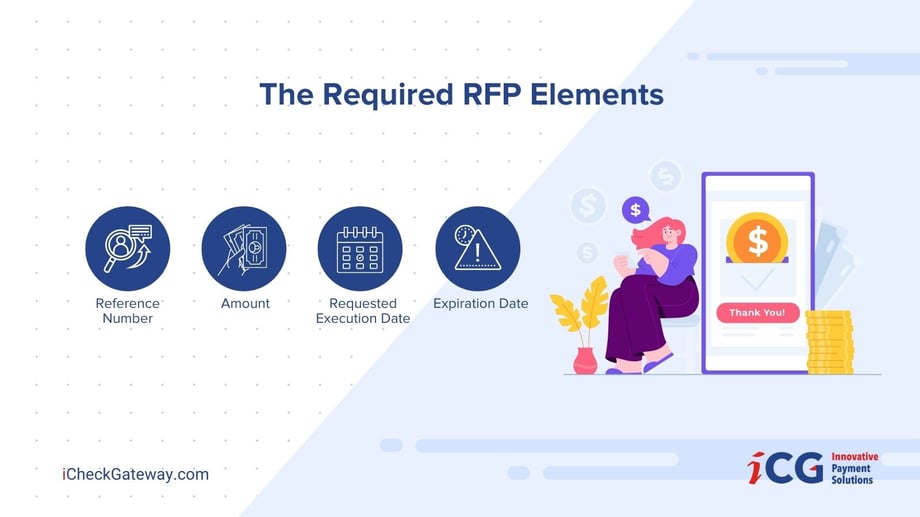

The Required RFP Elements

Four points are required for an RFP and there are four optional elements that only help further enhance the value (if utilized). The four required points are:

-

Reference Number: an identifying number or code associated with the payment – remains unchanged throughout the RFP chain.

-

Amount: shows the amount due, simplifying the work required from recipients. This ensures accuracy and reduces the recipient's chance of inputting the wrong amount.

-

Requested Execution Date: informs the recipient of a due date or pay-by date.

-

Expiration Date: date and time after which a recipient can no longer view or access the RFP. These dates help reduce outdated RFPs remaining in banking apps.

The Optional RFP Elements

The following four points are optional additional information elements that serve to enhance or customize the RFP:

-

Amount Modification Indicator: allows recipients to adjust the amount paid on an RFP, like spending more or less than the amount due on a credit card bill.

-

Early Payment Indicator: allows recipients to complete payment before the Requested Execution Date. This can be used as an incentive to customers, such as receiving a discount for paying an invoice before the due date. Or recipients can pay early for peace of mind.

-

Remittance Information: any additional invoice details or remittance data displayed in a hyperlink or by leveraging ISO 20022 to provide more customized and detailed information.

-

Status Codes: if enabled by the financial institution, status codes allow requesters and recipients to check on the status of their RFP. This includes when the RFP was received by the financial institution, when it was presented to the recipient, and when the recipient accepted and rejected the RFP.

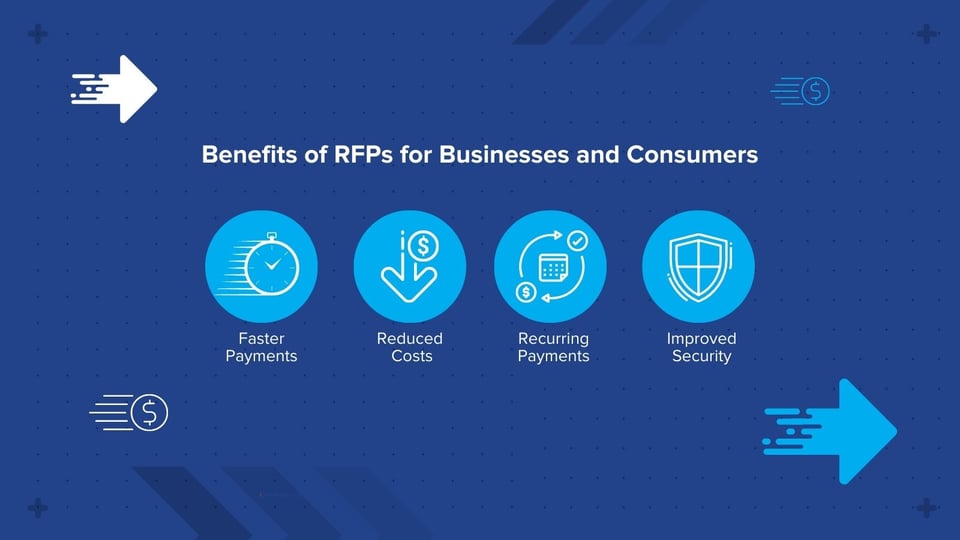

Examining the Benefits of RFPs for Businesses and Consumers

More than just a real-time, data-rich payment solution, Request for Payment benefits significantly by using the ACH process. RFPs provide benefits for businesses and consumers, including:

-

Increasing electronic and mobile payment adoption, allowing for faster payments.

-

Reducing costs associated with paper invoices and checks.

-

Providing a variety of payment methods through invoice notification. Opening the door to SMS payments, mobile payments, ACH, credit cards, and more.

-

Automated reminders and the ability to turn on recurring payments.

-

Improved security through end-to-end identification and encryption.

As ACI Worldwide says, RFP “is safe, secure and brings about more control and visibility for end consumers and businesses,” and it is “augmenting the end consumer experience.”

RFP in the Real-World

The applications of Request for Payment into your business or lifestyle are endless. One easily identifiable example is that of payment apps – Venmo, PayPal, and Zelle.

After having dinner with your friends or paying a shared bill, you can request any amount to the parties involved. All they must do is click “Pay” – that’s it, and that’s RFP. Millions of consumers worldwide already use the RFP process, making the implementation of RFPs into your business and e-commerce that much more vital.

According to American Banker, “The overall market for real-time payments is expected to advance at a compound annual growth rate of 33% over the next 10 years, reaching a yearly volume of about $300 billion by 2032.”

Banks like U.S. Bank and Bank of America are just two of hundreds of banks across the United States and the world that utilize Request for Payment services.

In November of 2021, U.S. Bank announced its expansion to provide better bill payment experiences to customers through RFP services. Since then, U.S. Bank clients have had access to real-time payments through popular payment options like SMS, Apple Pay, and Google Pay. U.S. Bank has also seen reduced costs due to fewer paper payments, improved visibility and speed of payments, and reduced customer friction.

The Bottomline

Digital payments are here to stay, and they have and will continue to transform the payments processing industry. Your business and consumers can achieve efficiency and security with Request for Payment, the ACH payments behind RFP.

Transform and automate your payment systems using modern payment methods by iCG, a Nacha-Preferred Partner. Get in touch with our experts for more information.