As technology continues to evolve, so do the payment methods we use to manage our bills. Digital payment methods such as eChecks have gained prominence as a seamless electronic alternative to traditional paper checks in the utility sector. While paper checks have a long history going back to the 1700s, they are losing their popularity to eChecks.

eChecks are way safer because there is no chance of payments getting lost in the mail, and the banking details are protected. From their speed and convenience to their security and cost-effectiveness, they streamline the payment process for both consumers and utility providers.

As a utility company, you need the right technologies to accept these forms of payment. Partnering with a reliable payment processor like iCG Pay, formerly iCheckGateway.com, allows you to process eChecks, especially for bill payments.

This blog post will examine how eCheck payment processing is an efficient payment option for utility companies.

What Are eChecks?

An eCheck, or electronic check, is a digital equivalent of traditional paper checks used for making payments. It offers speed and more convenience than paper checks. eChecks are highly secure because they leverage the Automated Clearing House (ACH) network to transfer funds securely between bank accounts.

Just like physical checks, eChecks contain essential payment information, including the payer's bank account number, routing number, and payment amount. However, they are processed electronically instead of being physically printed and mailed, expediting the payment process.

Additionally, these transactions are protected by layers of authorization and encryption technologies. The receiver gets the cash only after authorization from the sender. With eChecks, users can authorize payments online or via mobile devices, making them a popular choice for various transactions, including utility bills.

Here’s how an eCheck transaction works:

- The company sends an authorization request. Like any other ACH payment, you need to fill out authorization forms, whether it's a one-time or recurring payment. The sender can authorize the transaction via a phone call, secure online form, or a signed document.

- Set up the payment: The provider adds the customer’s payment information on a gateway like iCG Pay.

What Are the Benefits of eChecks for Utility Companies?

You need to invest in online payment technologies for your utility company to grow. Shifting to digital processes comes with multiple benefits. Here are the reasons why you need to use eChecks:

Cost-Effectiveness

Paper checks are costly for both the company and the consumer. A check order can cost up to 30 cents per check, depending on the specific bank. The utility company also incurs a lot of processing and labor costs, which can eat into your profits. However, transitioning to eChecks reduces these operational expenses.

They eliminate printing, postage, manual processing costs, and payment fraud risk. Additionally, eChecks can be processed in large numbers, further enhancing their cost-effectiveness. They are also cheaper than credit card payments because the payment processing fees are lower, and there are no interchange fees. This is ideal for consumers looking to save costs.

Faster Processing

ACH processing for utilities is expedited. Unlike paper checks, which must be physically mailed and manually processed, eChecks can be processed electronically. This means that funds are transferred between accounts more quickly, reducing the processing time it takes for payments to clear.

As a result, utility companies can access funds sooner, improving cash flow and revenue collection. This cash can be used to improve operations and service delivery.

Reduced Fraud Risk

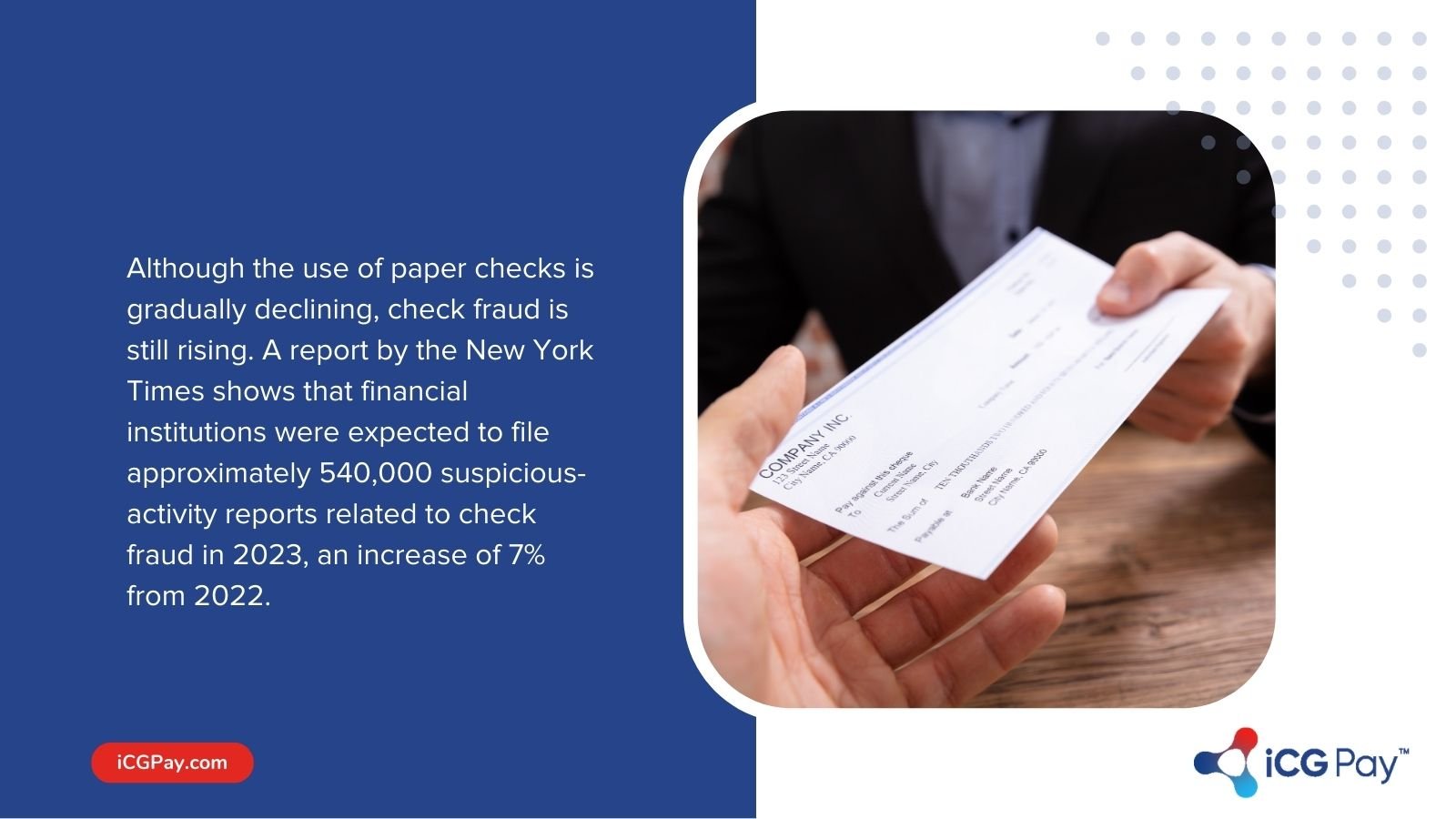

Although the use of paper checks is gradually declining, check fraud is still rising. A report by the New York Times shows that financial institutions were expected to file approximately 540,000 suspicious-activity reports related to check fraud in 2023, an increase of 7% from 2022.

An advantage of using eChecks for utility payments is the security features that mitigate the risk of fraudulent transactions. Compared to paper checks, which are susceptible to alteration and counterfeiting, eChecks have encryption technologies to safeguard sensitive payment information, ensuring that it remains confidential during transmission. Additionally, the authentication protocols verify the legitimacy of transactions, reducing the likelihood of unauthorized payments.

Improved Cash Flow

The faster processing times associated with eChecks contribute to more predictable and consistent cash flow for utility companies. Online billing solutions ensure that you receive payments more quickly. This way, your utility company can better manage its financial obligations, such as operational expenses, debt servicing, and investment activities.

Additionally, since most transactions are recurring payments, you can predict the expected revenue and adapt more effectively to changing market conditions.

Enhanced Customer Experience

Providing multiple convenient payment options keeps your customers happy. With eCheck payment processing, customers authorize eCheck payments online or through mobile devices, eliminating the need for paper checks and postage. Furthermore, they can set up recurring payments or make one-time payments according to their preferences.

To accept multiple payment options, consider a technology partnership with processors like iCG Pay. This partnership gives you access to additional technologies like hosted payment portals, email invoicing, and IVR payments.

How Secure Are eChecks?

With the rise in payment fraud, you need a secure payment method. A digital check is more secure because of these factors:

- Regulatory and Industry Standards: eCheck transactions are subject to regulatory requirements and industry standards designed to protect consumer privacy and financial data. Since eChecks are processed via the ACH network, they are governed by Nacha standards, which mitigate security risks in the Check payment systems.

- Check Verification Services: Once you partner with a reliable processing gateway like iCG Pay, you can access iCG-Verify technologies for your utility business. Check verification detects and prevents fraud in the payment systems.

- Payment Authorization: Before initiating an eCheck transaction, customers must provide authorization through secure channels. This involves authentication methods such as passwords, PINs, or biometric verification. The ACH transfer will not be processed if the customer has insufficient funds. Authentication minimizes the risk of fraudulent transactions initiated by unauthorized individuals.

Optimize Utility Payment Processing with iCG Pay

Electronic check payments are a highly secure payment method for utility companies. To effectively process these eChecks, you need a one-stop solution like iCG Pay, which is specifically designed to meet the industry's needs. Our robust security features are PCI compliant, protecting your transactions from unauthorized access.

Want to learn more about eChecks and iCG-Verify? Schedule a call with our team of experts!