In today’s digital age, electronic payments are essential for business transactions. McKinsey’s 2021 Digital Payments Consumer report revealed that 82% of Americans use digital payments. This definition of digital payments includes browser-based or in-app online purchases, in-store checkout using a mobile phone and/or QR code, and person-to-person (P2P) payments. This figure is higher than last year’s 78% and the 72% recorded five years ago. Most electronic payments, aka electronic funds transfer (EFT), happen via payment rails. Payment rails refer to the infrastructure that connects different financial institutions and enables funds transfers between accounts. In the U.S., we have access to the following payment rail options:

- ACH

- Credit Cards

- RTP (Real-Time Payments)

- FedNow

- Wire Transfers

Each payment rail has its advantages and disadvantages, so choosing the right one to meet your needs is essential. Let’s discuss the differences between these payment rails to help you choose the right one for your business needs.

What Are ACH Payments and Their Top Security Features?

ACH payments are electronic transfers that move funds between bank accounts in the U.S. ACH transfers take two to three business days to process. Still, they are secure and inexpensive, making them an ideal payment method for businesses with recurring payments.

One of the advantages of ACH payments is their security features. Nacha data shows that unauthorized returns constitute less than 0.03% of ACH transactions. ACH payments use encryption and authentication protocols to protect banking information and prevent unauthorized access. They are also subject to the Federal Reserve’s Regulation E, which protects against errors and fraud, thus making them a reliable payment method.

Understanding Credit Cards and Their Fees

Credit cards offer the convenience of instant payment processing, but they come with a discount rate and processing fees that can add up over time.

Credit card network fees are the costs merchants pay to accept credit cards as a payment method. These include the interchange fee, the percentage of each transaction that the card issuer charges to the merchant, and the credit card processing fee, which is the fee charged by the credit card processors to handle the payment transaction.

Discount rates, interchange fees, and credit card processing fees vary between payment processors and card issuers. Businesses should research and compare processing companies and merchant services to find the best rates and fees for their needs. Additionally, accepting credit cards can increase sales and customer satisfaction, but weighing the costs and benefits of accepting credit cards is essential before making a final decision.

Learn more about credit card processing here.

What Is FedNow and How Will It Affect the Payment Industry?

The Federal Reserve Bank’s upcoming payment rail, FedNow, is expected to launch in July 2023. FedNow will offer 24/7 instant payment capabilities to consumers and businesses. According to a report by the Federal Reserve, the impact of FedNow on the payment industry will depend on how widely it is adopted. Learn more about Fednow.

This payment rail aims to provide instant payments between accounts, making it an ideal payment method for businesses that require faster payments. FedNow will provide an alternative to existing payment rails and increase competition among payment processing companies. According to a report by the Federal Reserve, FedNow will improve access to faster payments, reduce fraud, and enhance the efficiency of the U.S. payments process.

How Do Wire Transfers Work and How Long Do They Take?

Wire transfers are a payment method that enables the near-instantaneous transfer of funds. However, wire transfer processing times can vary depending on the country and financial institution involved. According to a report by TransferWise, wire transfer processing times can range from one to five business days, with fees varying depending on the size and destination of the transfer. Compare ACH and wire transfer speeds here.

Wire transfers move funds between accounts and are typically used for high-value transactions. They are processed in real-time, making them an ideal payment method for businesses that require faster payments. However, wire transfers have a higher processing cost than other payment rails, requiring bank account information to initiate the transfer. According to a report by the Federal Reserve, the average price of a domestic wire transfer in 2020 was $25.60.

What Are the Core Advantages and Disadvantages of Real-Time Payments (RTP)?

Real-Time Payments (RTP) is a newer rail enabling near-instantaneous payments. According to The Clearing House, which operates the RTP network, RTP adoption rates are rapidly increasing, with over 1 billion transactions processed since its launch in 2017. Learn more about faster payment systems for banks.

RTP offers several advantages, including faster payments, enhanced security, and increased transparency. However, RTP adoption rates may be limited due to its current availability only to financial institutions and not yet to individual consumers. Additionally, RTP fees may be higher than ACH fees and may not be cost-effective for smaller businesses.

Want to know more about Faster Payment Systems? Download our free eBook below!

Comparing ACH, Credit Cards, RTP, FedNow, and Wire Transfers

The following table compares ACH, credit cards, RTP, FedNow, and wire transfers based on processing times, fees, and security features:

|

Payment Rail |

Processing Time |

Fees |

Security Features |

|---|---|---|---|

|

ACH |

1-2 business days |

Low |

Banking information required |

|

Credit Cards |

Near-instantaneous |

High |

Card information required |

|

RTP |

Near-instantaneous |

High |

Enhanced security |

|

FedNow |

Near-instantaneous |

Unknown |

Enhanced security expected |

|

Wire Transfers |

1-5 business days |

High |

Banking information required |

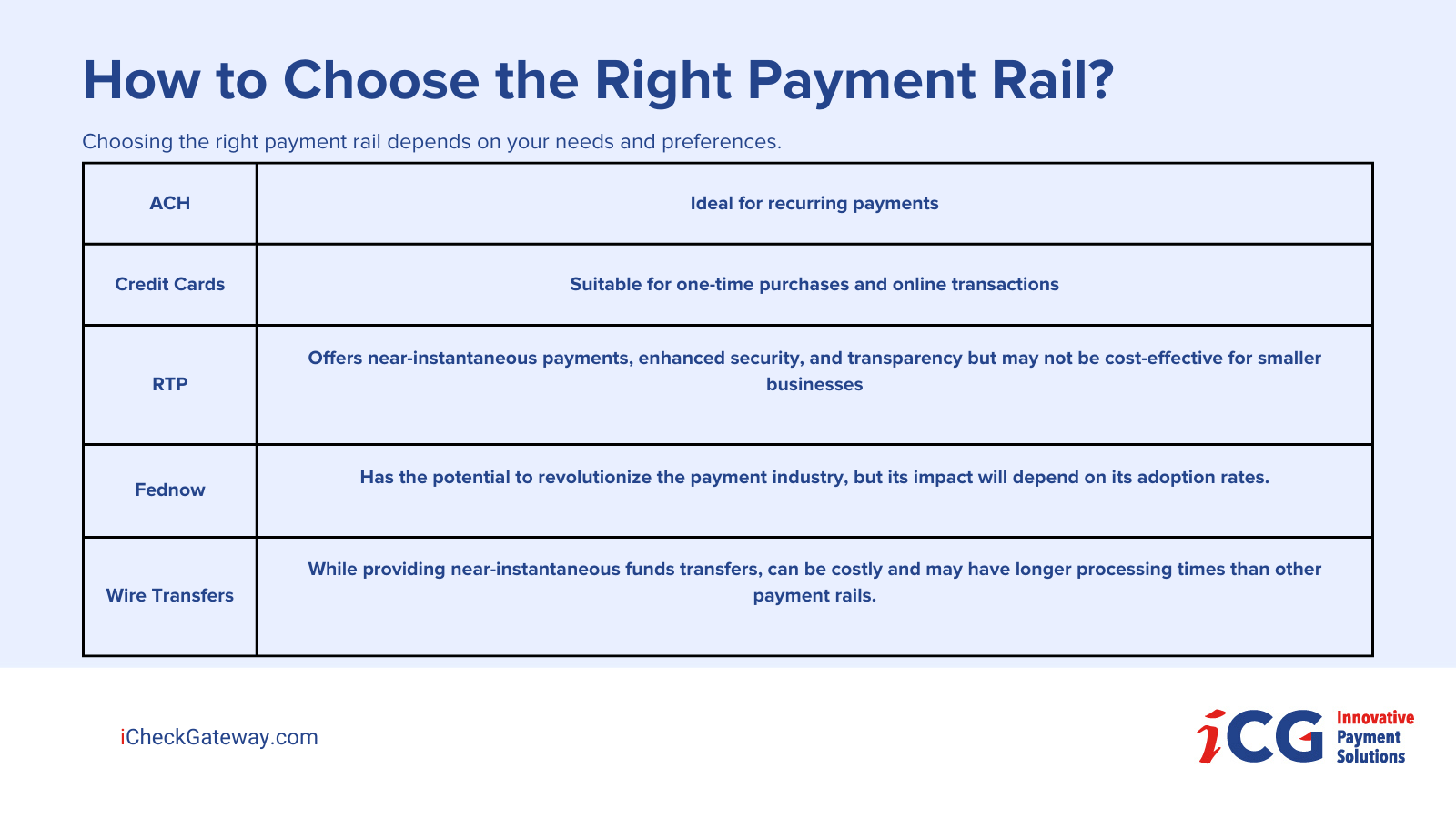

Choosing the Right Payment Rail Depends on Your Needs and Preferences

- ACH transfers are ideal for recurring payments.

- Credit cards are suitable for one-time purchases and online transactions.

- RTP offers near-instantaneous payments, enhanced security, and transparency but may not be cost-effective for smaller businesses.

- FedNow, the upcoming payment rail from the Federal Reserve Bank, has the potential to revolutionize the payment industry, but its impact will depend on its adoption rates.

- Wire transfers, while providing near-instantaneous funds transfers, can be costly and may have longer processing times than other payment rails.

In conclusion, understanding the differences between payment rails can help you decide which method to use for your business or personal transactions. Consider each payment rail's processing times, fees, and security features to determine the best fit for your needs. Want to start processing ACH and credit card payments on a single platform? Get in touch with us today!