As you gear up for the holiday season, the spike in online transactions brings an elevated risk of cyber threats and fraud.

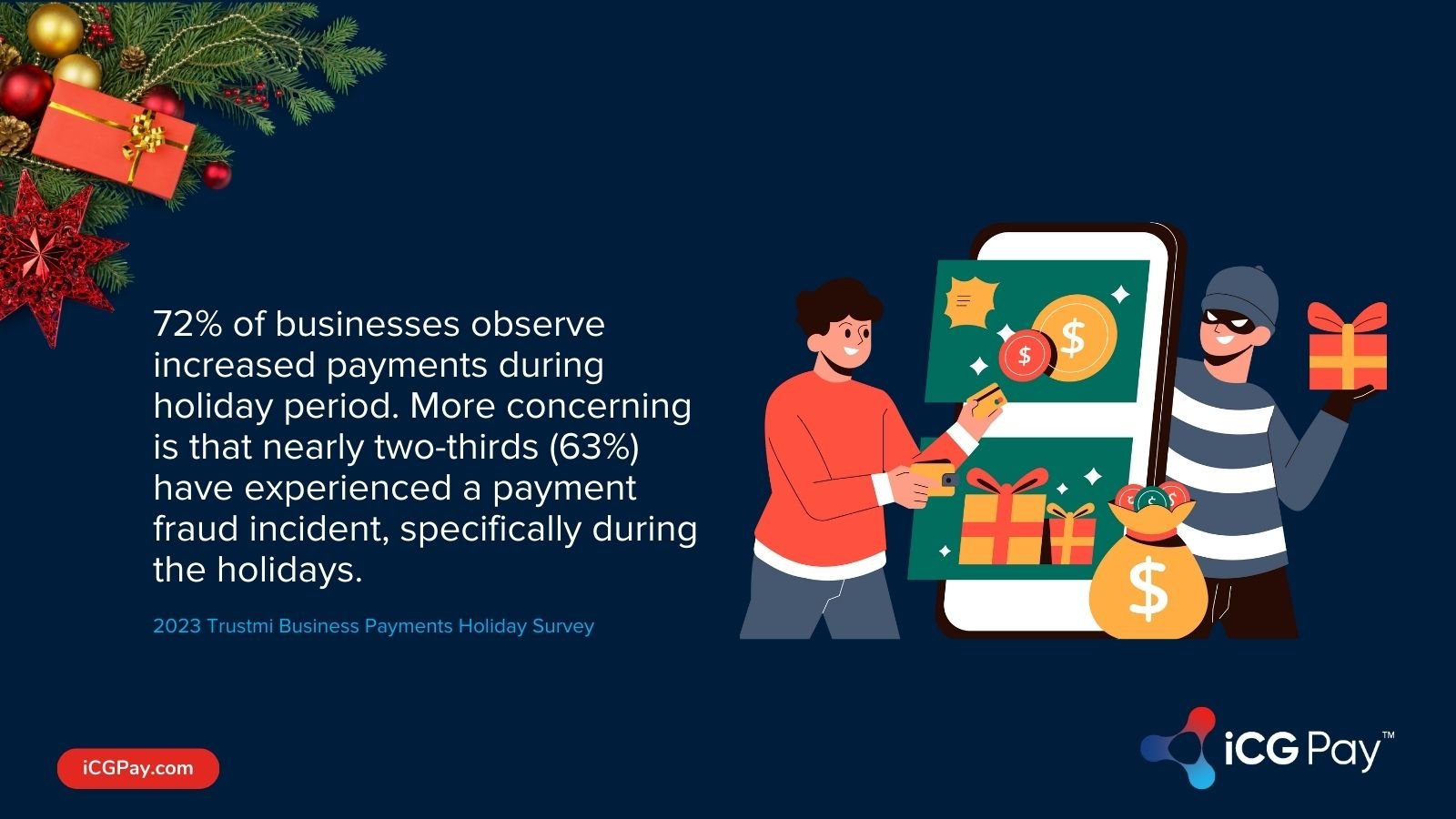

According to the 2023 Trustmi Business Payments Holiday Survey, 72% of businesses observe increased payments during this period. More concerning is that nearly two-thirds (63%) have experienced a payment fraud incident, specifically during the holidays.

This alarming trend underscores the critical need for robust payment processing solutions during this period and even after.

iCheckGateway.com (iCG Pay) is a powerful omnichannel payment processing platform designed to address these challenges.

Our commitment to security is evident in our multifaceted approach. End-to-end encryption and iFrame implementation form the core of our transaction security. We ensure data integrity from the point of sale to final processing.

We will explore how iCG Pay's innovative solutions can safeguard your business during the high-stakes holiday period, ensuring peace of mind in a time of increased vulnerabilities.

Holiday Season Security Risks

The first step is awareness. You can't effectively safeguard your business against these cybersecurity threats during the holiday season without understanding the nature and mechanisms of these risks.

With heightened online activity, your business is more vulnerable to various security threats, from sophisticated cyber attacks to common fraud attempts.

Here, we break down these risks, categorizing each threat and explaining how it typically occurs:

|

Security Risk |

How Does it Happen |

|

Phishing Attacks |

Fraudsters send deceptive emails or messages, mimicking legitimate sources, to steal sensitive information like login credentials or credit card numbers. They often exploit the high volume of promotional communications during the holidays. 75% of targeted cyberattacks start with an email. |

|

Credit Card Fraud |

This occurs when stolen card information or counterfeit cards are used for unauthorized purchases. It's more common during the holiday rush due to the sheer volume of transactions. |

|

Data Breaches |

Data breaches happen when your security systems are overwhelmed or exploited, leading to unauthorized access and theft of sensitive customer information, such as personal and payment details. |

|

DDoS Attacks |

Distributed Denial of Service attacks flood your website with excessive traffic, causing it to crash. During peak shopping, these attacks can disrupt sales and damage customer trust. |

|

Insecure Payment Gateways |

Payment information can be intercepted or stolen when transactions are processed through gateways without robust encryption and security measures. |

Understanding these risks is crucial in developing effective mitigation strategies, especially during the high-stakes holiday shopping season. You’ll also know what to look for in a payment processor provider.

The Role of Secure Payment Gateways

In business, strategic partnerships are key to enhancing operational efficiency and expertise.

For example, trying to do all the complex tasks related to payment processing in-house, especially during high-traffic periods like the holiday season, can be overwhelming and potentially risky for businesses.

Leveraging the specialized skills and advanced technology of a dedicated payment processor is essential to mitigate these risks and ensure smooth transactional operations.

A payment processor like iCG Pay, which has been in the business since 2008, brings invaluable experience. Trusted by Nacha as a Preferred Partner, we know the ins and outs of security and are well-placed to navigate the online payment risks.

Here's how a payment processor contributes to maintaining a secure transaction environment:

- Encrypted Transactions: iCG Pay ensures that sensitive information, such as credit card numbers and personal details, is encrypted from the moment it is entered until it reaches the processing bank. This guards against data breaches and unauthorized access.

- Fraud Prevention: iCG Pay's solutions are equipped with advanced fraud prevention tools. These tools scrutinize transaction patterns and flag unusual activities, significantly reducing the risk of fraudulent transactions. By utilizing machine learning and real-time analytics, iCG Pay can identify and prevent potential fraud before it impacts your business and customers.

- Compliance with Standards: Secure payment gateways adhere to stringent industry standards, such as PCI DSS (Payment Card Industry Data Security Standard). iCG Pay, being a Level 1 PCI-DSS certified service provider, ensures that all transactions comply with these standards, thus maintaining the highest level of security.

- Simplified Payment Processing: iCG Pay streamlines the payment process by consolidating various forms of payment into one platform. This simplification is crucial during the holiday season when facing a high volume of diverse transactions.

- Enhanced Customer Experience: A secure payment gateway protects and enhances the customer experience. iCG Pay's smooth and reliable transaction process increases customer confidence and satisfaction.

- Advanced Security Features: iCG Pay incorporates additional security measures like tokenization, BIN filtering, and anti-bot measures. These further fortify the security of each transaction.

Mobile Payment Security: Safeguarding On-the-Go Transactions

In 2022, mobile devices accounted for 63% of all online shopping traffic throughout the holiday season, peaking at 68% during key shopping periods like Christmas and Boxing Week.

This increase from 60% in 2020 shows that more and more consumers prefer shopping on their mobile devices.

As a result, mobile payment security is crucial. You must ensure your business safeguards these customers using their mobile devices to shop.

Recognizing this need, iCG Pay has developed mobile-friendly security features to address this demand. Here are key aspects of iCG Pay's approach to mobile payment security:

- Point-to-Point Encryption: This technology guarantees that customer data is encrypted right from the point of entry, ensuring that sensitive information is never exposed during the transaction process. This level of security matches the security offered in in-store processing.

- Secure Gateway Processing: All mobile transactions are processed through iCG Pay's secure gateway. This provides an additional layer of security and reduces the PCI scope for businesses, minimizing their compliance burden.

- No Storage of Sensitive Data: With iCG Pay, sensitive customer or transaction information is never stored on the mobile device. This greatly reduces the risk of data breaches and unauthorized access to sensitive information.

- Electronic Signature Authorizations: For added security in mobile transactions, iCG Pay allows the collection of electronic signatures. This feature is for businesses that conduct transactions in the field, adding an extra layer of verification and security.

- Blending Security with Convenience: iCG Pay's mobile payment solutions are designed to offer the perfect balance between security and ease of use. The platform ensures that while transactions are secure and compliant, they are also straightforward and user-friendly.

Real-Time Monitoring and Analytics for Enhanced Security

Real-time monitoring allows for the instantaneous detection of unusual or suspicious transaction patterns. This immediate response is crucial in preventing potential fraud before it causes significant damage.

For example, consider a scenario where your business processes a certain volume of transactions daily, with an average transaction value within a specific range.

Real-time monitoring systems immediately flag these anomalies if there's an influx of high-value transactions or a significant increase in transaction volume from unfamiliar locations.

This prompt detection enables you to investigate and determine whether these are legitimate transactions or fraudulent activities.

Real-time monitoring systems, like those employed by iCG Pay, can differentiate between expected seasonal variations and genuine threats. So you won’t have to worry that they will detect false positives when there is an influx during the holiday season.

In addition, by identifying and stopping these transactions before they are completed, you can prevent chargebacks that would occur if customers report unauthorized or fraudulent charges on their accounts.

Analytics tools can also identify unusual transaction patterns that may indicate chargeback fraud, where a customer makes a purchase and then intentionally disputes the charge.

Get Started with iCG Pay During this Holiday Season

This period, characterized by a significant increase in online and mobile transactions, brings a heightened risk of fraud and cyber threats.

A secure and reliable payment processor is necessary for businesses aiming to protect their operations and maintain customer trust.

With its advanced security features like real-time monitoring, end-to-end encryption, and fraud prevention mechanisms, iCG Pay offers a comprehensive shield against the risks associated with holiday season transactions.

Schedule a 30-minute discovery call with iCG Pay today and explore how our payment processing solutions can provide you with enhanced security and peace of mind during this holiday.